Assessor Contact Information

Assessments Division

The primary purpose of the Assessments Division is to estimate the fair market value, or “true cash value,” of all real and personal property located within the city of Flint. To estimate the market value, we use two years of sales and market data and collect information about properties. The State of Michigan Constitution and Statute require that, notwithstanding any other provision of law, the assessed values placed upon the assessment roll shall be at 50% of true cash value.

The Assessments Division is responsible for keeping records on all properties, including land and buildings. We are also responsible for property transfer affidavits, principal residence exemptions, land splits, and combinations.

Annual Notice of Assessment

A Notice of Assessment is mailed to each property owner at the end of February each year as notice of these values. This notice states on top “This is not a tax bill”. The only time these values may be appealed is during the March Board of Review. The dates and times of these meetings are on the Notice of Assessment. At the close of the March Board of Review, the values become final and cannot be appealed, with the exception of Commercial and Industrial Property, which may be appealed directly to the Michigan Tax Tribunal by May 31.

Board of Review Public Notices

| Date | Description | Attachments |

|---|---|---|

|

Date

January 2, 2025

|

Description

2025 Board of Review Meeting Public Notice |

Attachments

|

|

Date

July 11, 2024

|

Description

2024 July Board of Review |

Attachments

|

What happens to taxable value when a property transfers ownership?

(If you recently purchased your home, you want to read this!)

In the year following the purchase of a property, the Taxable Value becomes equal to the Assessed Value. This is commonly referred to as “uncapping.” In the second year after a property is purchased, the Taxable Value is again capped, and may only increase by the Inflation Rate Multiplier (IRM) or 5%, whichever is lesser of the two, provided there is no new construction or losses. In Michigan, taxes are based on Taxable Value. Taxable Value can never be greater than the Assessed Value.

When a property transfers ownership, the taxable value uncaps to the current assessed value. For an example:

2024 Taxable Value 45,352

2024 Assessed Value 60,000

Date of sale 10/31/2024

2025 Taxable Value 65,000

2025 Assessed Value 65,000

This is a STATE law and the local government or board of review have no authority to change this impact.

Unfortunately, Proposal A is typically no longer stressed to new buyers during the process of buying property in Michigan. The officials at the City are not aware of a transfer until after it occurs and become responsible for educating the new buyer. If your taxes are in escrow, please contact your mortgage company when you receive your assessment change notice, with the potential increase so they can adjust your payment. If not, you may see a significant increase in your payment next year.

Assessment Division Documents

| Resource | Description | Actions |

|---|---|---|

| Request for Inspection | Requests for records and copies of Assessing documents can be made through the Assessing office by calling 810-766-7255 or [email protected]. Our team will respond to your request within one business day. Requests for inspections of property, please contact Teresa Trujillo at [email protected] or call 810-766-7255. | Open File | Download |

| Request to Rescind Principal Residence | Property owners are required to file a Rescission when they no long occupy their property as their Principle Residence. If this form is not filed, it could lead to a denial from the Assessor's office or Principle Residence Division at the State. This denial will include fines and penalties, on top of the 18 mills of the School Operating taxes. | Open File | Download |

| Principal Residence Exemption | The property must be owned and occupied by June 1 of the current year to qualify for a Principle Residence Exemption. This exemption removed 18 mills of operational taxes from your property tax bill. | Open File | Download |

| Property Transfer Affidavit | This form must be filed with the local assessing department when there is a transfer of ownership. | Open File | Download |

| 2025 MBOR time and dates | Times and Dates for the March Board of Review. Call 810-766-7255 for questions or an appointment. Once March Board is Closed, the Assessment department no longer has legal authority over assessed values. | Open File | Download |

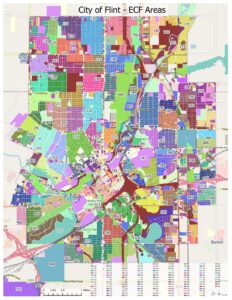

| 2025 Residential ECF Study | How residential assessed values are determined | Open File | Download |

| How To Read Your Assessment Change Notice | Every year property owners will receive an assessment change notice around last weekend in February. This notice will let the property owner now what their new assessed and taxable values are, as well as giving them an idea of the amount their taxes will increase. | Open File | Download |

| Special Assessment Exemption Affidavit | For those properties purchased from the Genesee County Land Bank, which are included in the Brownfield Plan, and can’t be combined with your principal residence, a yearly filed affidavit will waive the lighting assessment. They are accepted in the month of April. The assessment office will send out an affidavit to those properties that qualify. | Open File | Download |

| 2026 Combination or Division Application | This application is submitted if a property owner would like to combined their adjacent properties or split them. The new parcel will be active for the 2026 tax year. | Open File | Download |

| Disabled Veterans Exemptions Affidavit | This application must be filed with your explanation of benefits to the Assessor's office. | Open File | Download |

| 2025 Homeowner Property Exemption (HOPE) | Homeowners may apply to one of the three (3) Boards of Review, March, July or December, one (1) time each year and reapply every year. This exemption does not provide relief for your water bill and is not available to renters. | Open File | Download |

| Board of Review Members Rules | in 2020 the Board of Review updated the rules they must follow when hearing appeals. Please review before you make your appointment. | Open File | Download |

Assessment Division Sales Documents

| Resource | Description | Actions |

|---|---|---|

| Request for Inspection | Requests for records and copies of Assessing documents can be made through the Assessing office by calling 810-766-7255 or [email protected]. Our team will respond to your request within one business day. Requests for inspections of property, please contact Teresa Trujillo at [email protected] or call 810-766-7255. | Open File | Download |

| Request to Rescind Principal Residence | Property owners are required to file a Rescission when they no long occupy their property as their Principle Residence. If this form is not filed, it could lead to a denial from the Assessor's office or Principle Residence Division at the State. This denial will include fines and penalties, on top of the 18 mills of the School Operating taxes. | Open File | Download |

| Principal Residence Exemption | The property must be owned and occupied by June 1 of the current year to qualify for a Principle Residence Exemption. This exemption removed 18 mills of operational taxes from your property tax bill. | Open File | Download |

| Property Transfer Affidavit | This form must be filed with the local assessing department when there is a transfer of ownership. | Open File | Download |

| 2025 MBOR time and dates | Times and Dates for the March Board of Review. Call 810-766-7255 for questions or an appointment. Once March Board is Closed, the Assessment department no longer has legal authority over assessed values. | Open File | Download |

| 2025 Land Analysis | How Land Values are determined. | Open File | Download |

| 2025 Commercial And Industrial Land and ECF Sales Study | How Commercial and Industrial assessments are determined | Open File | Download |

| 2025 Residential ECF Study | How residential assessed values are determined | Open File | Download |

| 2025 Residential Sales | Residential sales by within the City of Flint | Open File | Download |

| How To Read Your Assessment Change Notice | Every year property owners will receive an assessment change notice around last weekend in February. This notice will let the property owner now what their new assessed and taxable values are, as well as giving them an idea of the amount their taxes will increase. | Open File | Download |

| Special Assessment Exemption Affidavit | For those properties purchased from the Genesee County Land Bank, which are included in the Brownfield Plan, and can’t be combined with your principal residence, a yearly filed affidavit will waive the lighting assessment. They are accepted in the month of April. The assessment office will send out an affidavit to those properties that qualify. | Open File | Download |

| 2026 Combination or Division Application | This application is submitted if a property owner would like to combined their adjacent properties or split them. The new parcel will be active for the 2026 tax year. | Open File | Download |

| Disabled Veterans Exemptions Affidavit | This application must be filed with your explanation of benefits to the Assessor's office. | Open File | Download |

| 2025 Homeowner Property Exemption (HOPE) | Homeowners may apply to one of the three (3) Boards of Review, March, July or December, one (1) time each year and reapply every year. This exemption does not provide relief for your water bill and is not available to renters. | Open File | Download |

| Board of Review Members Rules | in 2020 the Board of Review updated the rules they must follow when hearing appeals. Please review before you make your appointment. | Open File | Download |